Understanding the Fintechzoom.com Nikkei 225 Connection

A Powerful Intersection of Finance and Technology

The Nikkei 225 index stands tall as one of the most crucial benchmarks for Japan’s stock market and plays a significant role in the global financial scene. When it comes to accessing in-depth, real-time financial data, Fintechzoom.com emerges as a trusted platform for investors, traders, and analysts who rely on accurate insights. The fintechzoom.com Nikkei 225 coverage provides vital information on stock performance, market forecasts, and global economic implications tied to the Japanese economy.

Fintechzoom.com has transformed how market data is presented, blending AI-powered analytics with human-driven insights. By regularly publishing updates on the Nikkei 225, it has become an indispensable tool for anyone involved in Asian financial markets.

The Role and Relevance of the Nikkei 225

Why the Nikkei Index Matters Globally

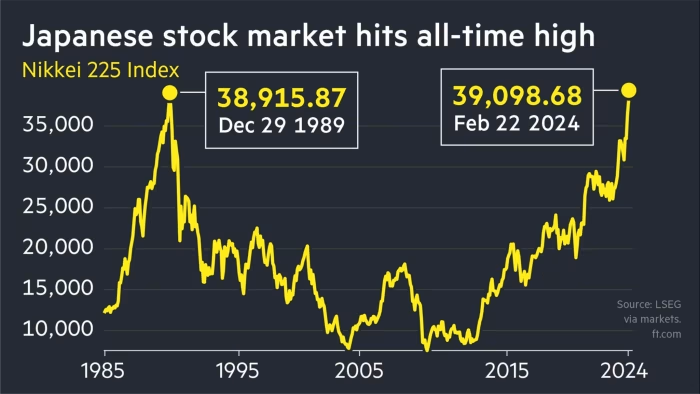

The Nikkei 225, often referred to simply as the Nikkei, is Japan’s premier stock index, tracking the performance of 225 large and publicly owned companies listed on the Tokyo Stock Exchange. The index includes global corporate giants like Sony, Toyota, and Mitsubishi, making it a powerful indicator of Japan’s economic health.

Fintechzoom.com nikkei 225 coverage highlights not just the day-to-day numbers but also the broader economic conditions, industry shifts, and investor sentiment driving the trends. In today’s fast-paced market, understanding this index is critical for global investment strategy.

Fintechzoom.com’s Coverage of the Nikkei 225

Real-Time Tools and Analytical Advantages

What sets Fintechzoom.com apart is its ability to consolidate vast amounts of financial data into a streamlined, user-friendly format. Their Nikkei 225 analysis offers daily, weekly, and monthly updates that include market summaries, top movers, sector performances, and technical indicators like RSI, moving averages, and Bollinger Bands.

These features offer an edge for both individual investors and institutions.

Global Ripple Effects of Nikkei 225 Movements

Impact Beyond Japan’s Borders

Changes in the Nikkei 225 don’t only affect Japan; they often signal larger movements in the Asian and global markets. As Japan is the third-largest economy in the world, a drop or rise in the Nikkei often ripples through European and North American markets.

Fintechzoom.com’s curated reports help demystify these linkages by breaking down complex global relationships into understandable visual graphs, financial commentary, and predictive analytics. This gives global investors better foresight into potential financial shifts.

Artificial Intelligence in Nikkei 225 Forecasting

How Fintechzoom.com Uses AI for Smart Insights

One of the most innovative aspects of fintechzoom.com’s coverage is the integration of artificial intelligence and machine learning algorithms. These technologies provide predictive models and sentiment analysis for the Nikkei 225, giving investors an edge in anticipating market movements.

By analyzing patterns in trading volume, market sentiment, and global financial news, AI-driven tools offer real-time actionable insights that help both day traders and long-term investors.

How Institutions Use Fintechzoom for Nikkei 225

Understanding Big Players’ Influence

Institutional investors like pension funds, hedge funds, and insurance companies hold a significant stake in the Nikkei 225, and their strategies can largely influence market movement. These investors use platforms like Fintechzoom.com to track large-cap stock behavior and identify macroeconomic indicators.

Fintechzoom’s analytics capture these shifts by tracking block trades, volume spikes, and sector-wide trends in real-time. This empowers smaller investors to align their strategies with institutional movements.

Nikkei 225 Versus Global Stock Market Indices

Comparing International Benchmarks

To get a broader perspective, it’s essential to compare the Nikkei 225 with other major indices like the S&P 500, FTSE 100, and DAX. The Nikkei 225 uniquely represents a powerful mix of industrial, technology, and consumer companies in Japan.

Fintechzoom.com’s comparison tools make it easier for investors to track multiple indices simultaneously and spot regional growth opportunities or emerging risks. This strengthens global investment strategies.

Sector-Based Analysis of the Nikkei 225

Highlighting Winning and Lagging Industries

Different sectors within the Nikkei 225 perform differently based on global trends, and Fintechzoom.com breaks this down clearly with its sectoral analysis. Sectors like technology, automotive, and healthcare typically dominate the index.

Fintechzoom’s reports on sectoral performance include year-to-date returns, historical volatility, and expert commentary. These insights help investors shift their exposure based on market dynamics and economic forecasts.

Educational Features on Fintechzoom.com

Financial Learning for Every Investor

In addition to delivering raw financial data, Fintechzoom.com also serves as an educational resource for both beginners and professionals. It offers tutorials, financial glossaries, market explainers, and expert analysis.

This content helps users understand the reasoning behind trends in the Nikkei 225 and gives them the confidence to make informed investment decisions.

Looking Ahead: The Future of Fintech and Nikkei Tracking

How Technology Will Reshape Global Market Monitoring

Looking ahead, the relationship between fintech platforms and global indices like the Nikkei 225 will only become more crucial. With more integration of blockchain, DeFi, AI, and cross-border analytics, platforms like Fintechzoom.com are already preparing for the next phase of financial evolution.

Fintechzoom is building features that go beyond simple charts and tickers—focusing instead on smart financial ecosystems that adapt to user behavior, market volatility, and global macroeconomic signals.

5 Key Takeaways from This Article

- Fintechzoom.com nikkei 225 offers real-time, data-rich insights crucial for investors.

- The Nikkei 225 reflects Japan’s economic trends and impacts global markets.

- AI integration on Fintechzoom.com enhances prediction and sentiment analysis.

- Sectoral tracking allows users to make informed, data-driven decisions.

- Fintechzoom doubles as an educational hub, supporting investor growth.

Conclusion: The Power of Fintechzoom.com Nikkei 225 Insights

The synergy between Fintechzoom.com and the Nikkei 225 creates a powerful resource for financial understanding and strategic investing. In today’s increasingly digital market environment, platforms that offer reliable data, intelligent forecasting, and user-friendly interfaces will dominate investor choice.

As Fintechzoom.com continues to evolve and expand its offerings, it will remain a key player in global financial analysis—especially for those monitoring the Nikkei 225. With access to this platform, investors are not just reacting to the market—they are anticipating it.

FAQs About Fintechzoom.com Nikkei 225

Q1: What is Fintechzoom.com?

A: Fintechzoom.com is a financial news and analytics platform offering real-time data and reports on global indices, stocks, crypto, and more.

Q2: Why is the Nikkei 225 important for investors?

A: It’s Japan’s leading index and reflects the health of the third-largest global economy, impacting global trade and investment decisions.

Q3: How accurate is Fintechzoom’s Nikkei 225 data?

A: The platform uses verified data sources and real-time tracking tools, ensuring high accuracy and timely updates.

Q4: Can beginners use Fintechzoom to track the Nikkei 225?

A: Yes, the site offers user-friendly tools and educational resources designed for all skill levels.

Q5: What sectors dominate the Nikkei 225 index?

A: Technology, automotive, finance, and healthcare are among the top-performing sectors in the Nikkei 225.

Also Read This: Understanding the 03316 Phone Number: Everything You Need to Know